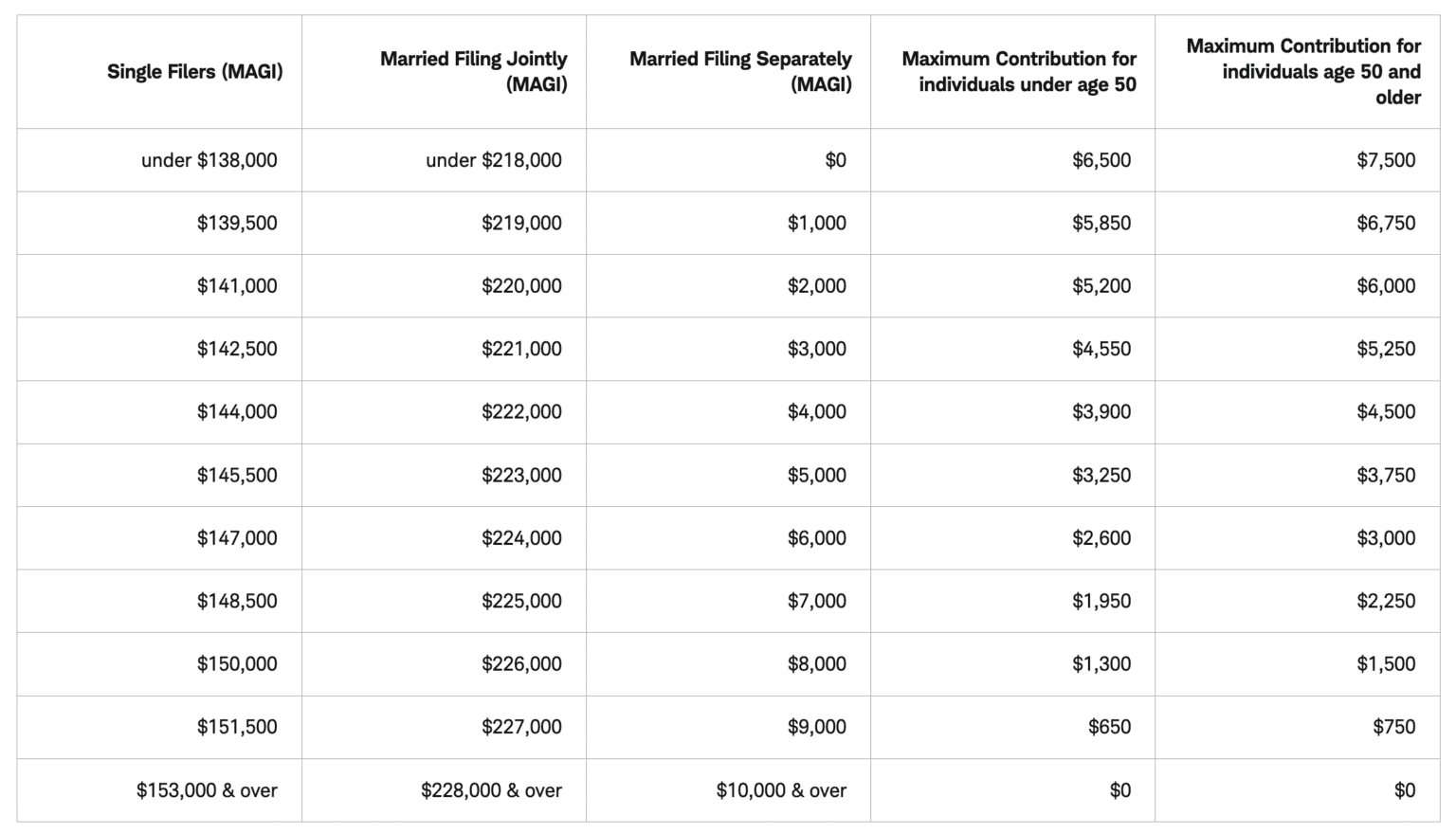

Roth Ira Conversion Limits 2024. To be eligible to contribute the maximum amount in 2024, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year). 12 rows if you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2024 to contribute.

But, for roth iras, you. Roth ira rules 2023 and 2024:

Roth Ira Contribution Limits (Tax Year 2024) Brokerage Products:

You're allowed to invest $7,000 (or $8,000 if you're 50 or older) in 2024.

The Combined Annual Contribution Limit For Roth And Traditional Iras For The 2024 Tax Year Is $7,000, Or $8,000 If You're Age 50 Or Older.

In 2024, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above.

But Other Factors Could Limit How Much You Can Contribute To Your Roth Ira.

Images References :

Source: fancyaccountant.com

Source: fancyaccountant.com

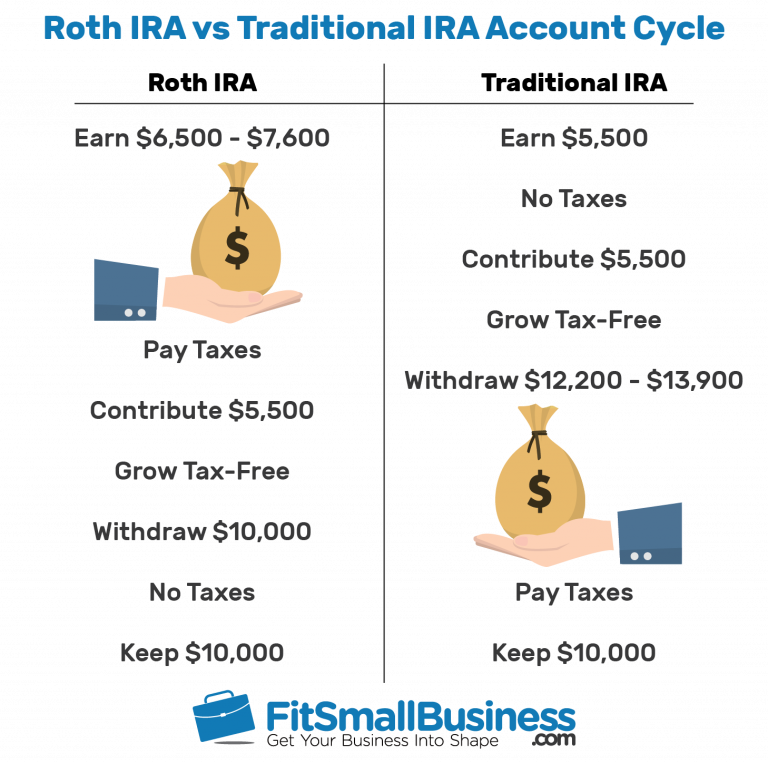

What is a Roth IRA? The Fancy Accountant, This figure is up from the 2023 limit of $6,500. The roth ira contribution limit for 2024 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, Is the backdoor roth allowed in 2024? 12 rows if you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2024 to contribute.

Source: www.financestrategists.com

Source: www.financestrategists.com

IRA Contribution Limits 2024 Finance Strategists, Best roth ira for mobile trading. Here's a closer look at.

Source: michaelryanmoney.com

Source: michaelryanmoney.com

Roth Conversion Calculator Use Our Roth IRA Conversion Calculator For, The combined annual contribution limit for roth and traditional iras for the 2024 tax year is $7,000, or $8,000 if you're age 50 or older. That means you'll be able to stash away up to $7,000 in a roth ira in 2024, up from $6,500 in 2023.

Source: www.bestpracticeinhr.com

Source: www.bestpracticeinhr.com

Roth IRA Rules, Contribution Limits & Deadlines Best Practice in HR, The motley fool has a disclosure policy. The roth individual retirement account (roth ira) has a contribution limit, which is $7,000 in 2024—or $8,000 if you are 50 or older.

Source: www.savingtoinvest.com

Source: www.savingtoinvest.com

Roth IRA contribution limits — Saving to Invest, Those limits reflect an increase of $500 over the. A conversion allows you to roll funds from a pretax retirement account into a roth ira.

Source: www.pinterest.co.uk

Source: www.pinterest.co.uk

Roth IRA Rules What You Need to Know in 2019 Roth ira rules, Roth, $8,000 in individual contributions if you’re 50 or. Earned income is the basis for contributions, while.

Source: www.carboncollective.co

Source: www.carboncollective.co

Roth IRA vs 401(k) A Side by Side Comparison, Is the backdoor roth allowed in 2024? Those limits reflect an increase of $500 over the.

Building a Roth Conversion Ladder Retirement Nerd, You will generally owe income taxes on the money you. For 2024, the roth ira contribution limits are going up $500.

Source: millennialmoneyveteran.com

Source: millennialmoneyveteran.com

Backdoor Roth IRA Conversion Overview and StepbyStep Guide, That means you'll be able to stash away up to $7,000 in a roth ira in 2024, up from $6,500 in 2023. If you are 50 or older, you can save an additional $1,000, totaling $8,000 across all accounts.

Even If Your Income Exceeds Contribution Limits For A Roth Ira, There's Still A Way To Fund One.

Here's a closer look at.

This Limit Applies Across All.

That means you’ll be able to stash away up to $7,000 in a roth ira in 2024, up from $6,500 in 2023.